For anyone owning a house, the high interest rates we’re all paying comes with a hit to our budgets: you’re now spending so much more on your mortgage. Depending on when you grabbed your home loan or when you last refinanced, that’s a problem, and the cost of a mortgage is now affecting everything else. This affects how we spend and how much stress is in our lives.

“Mortgage Stress” is a term used to describe when we’re spending more of our income than expected on a home loan, but it’s more than a term: it’s a number, and it can be explained.

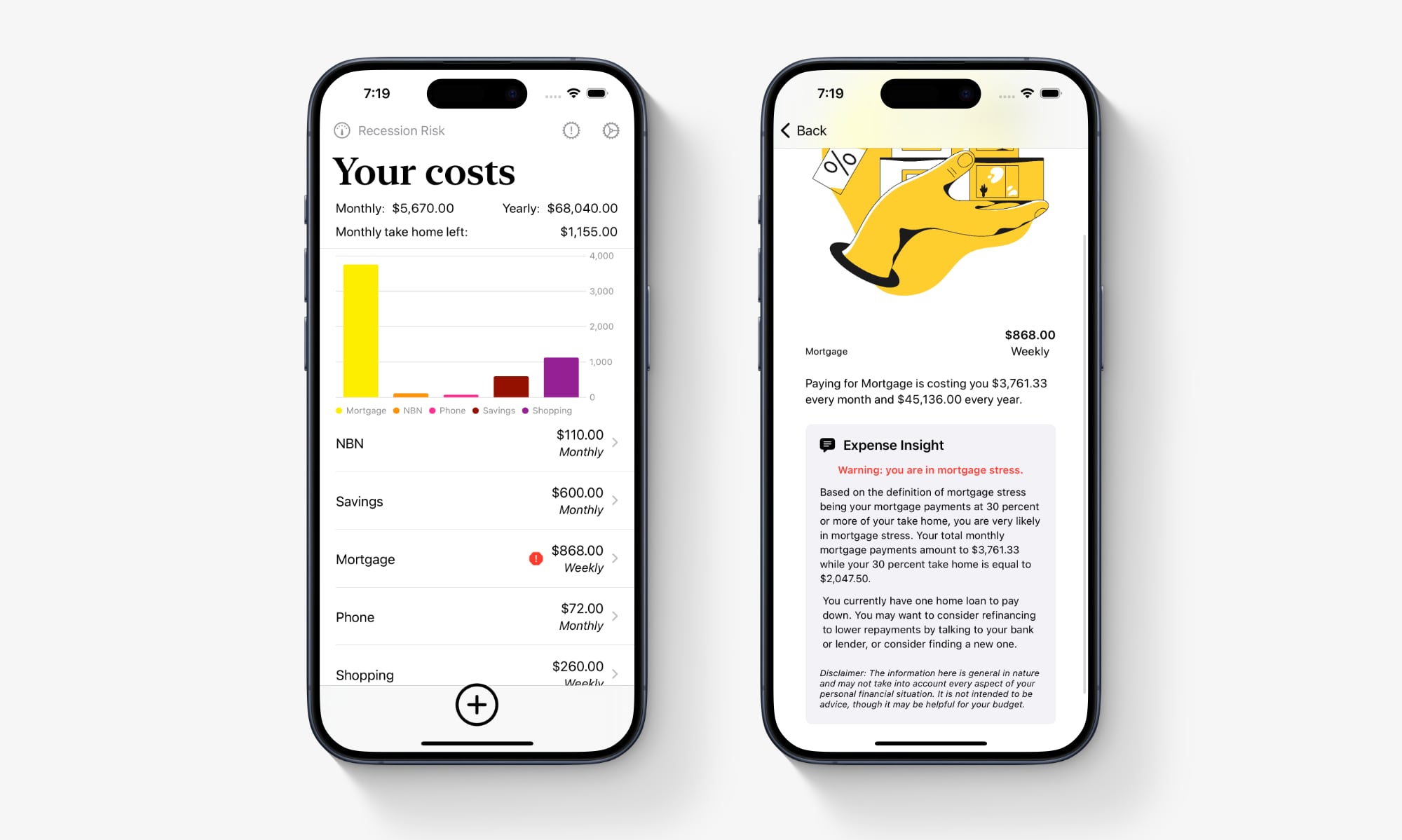

So with a recent update to Simplsaver, we’ve added a feature that can help warn when a budget is potentially dealing with Mortgage Stress.

Anyone can do it free in the app: all you need is your monthly take home and a budget item for your mortgage. This can be added in mere seconds, and you’ll either get a red mark noting whether you’re in Mortgage Stress, or none showing you’re fine. From there, you can find out how much your mortgage is affecting your budget with the numbers to prove it.

Mortgage Stress is typically defined as having 30 percent or more of your pre-tax income going to your mortgage repayments. Unfortunately, that means your budget may not have an impact on fixing the problem of mortgage stress itself.

However, if you’re aware of your situation and how much you spend, you can quickly work out whether your budget is having you live beyond your means, and take steps to alleviate some of the stress in the process.

The addition of Mortgage Stress indicators join Simplsaver’s other exclusive features, including an Extra Weight score to identify costs you might be able to remove, as well as its exclusive Risk of Recession score to interpret how the Consumer Price Index in your country could affect your budget.