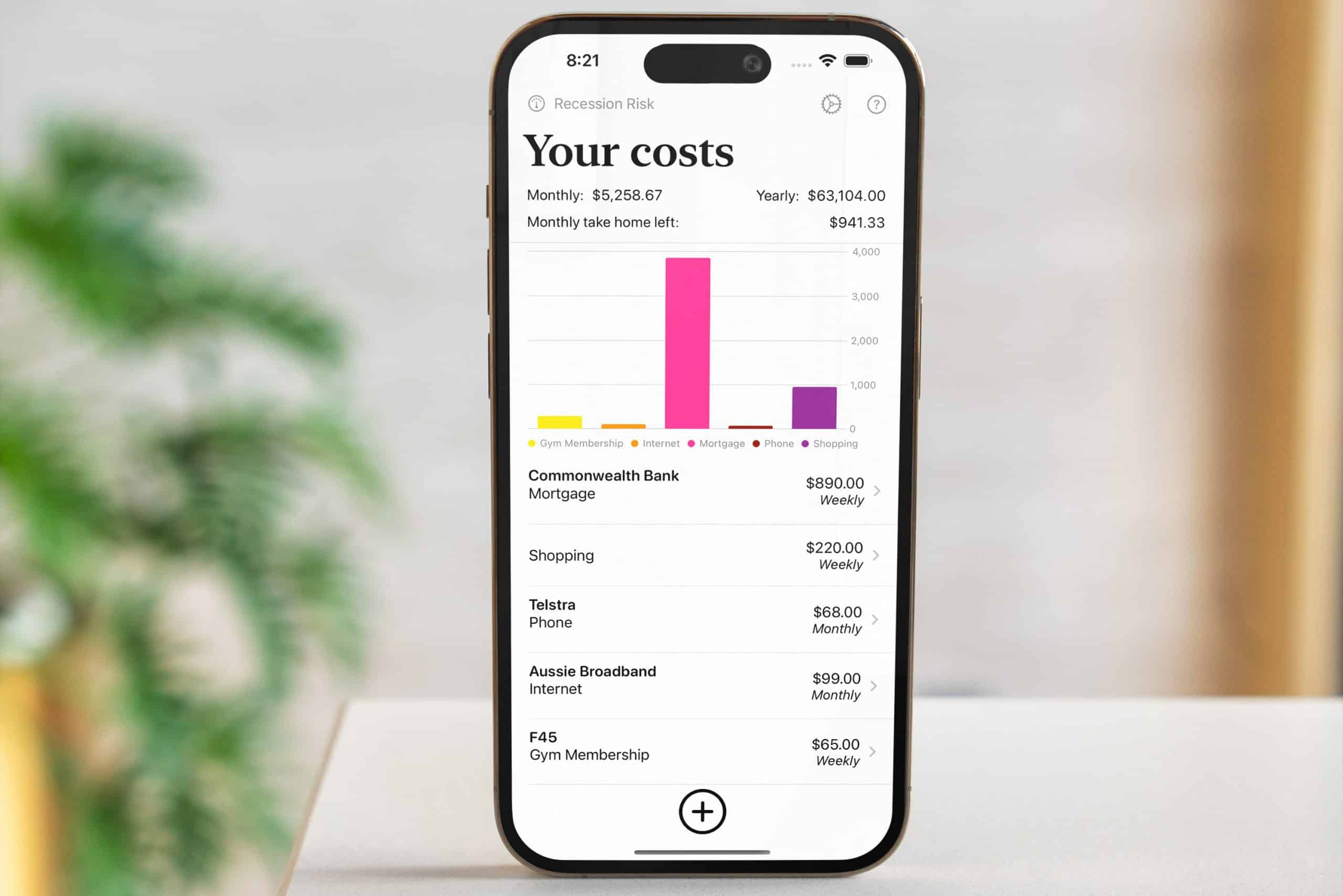

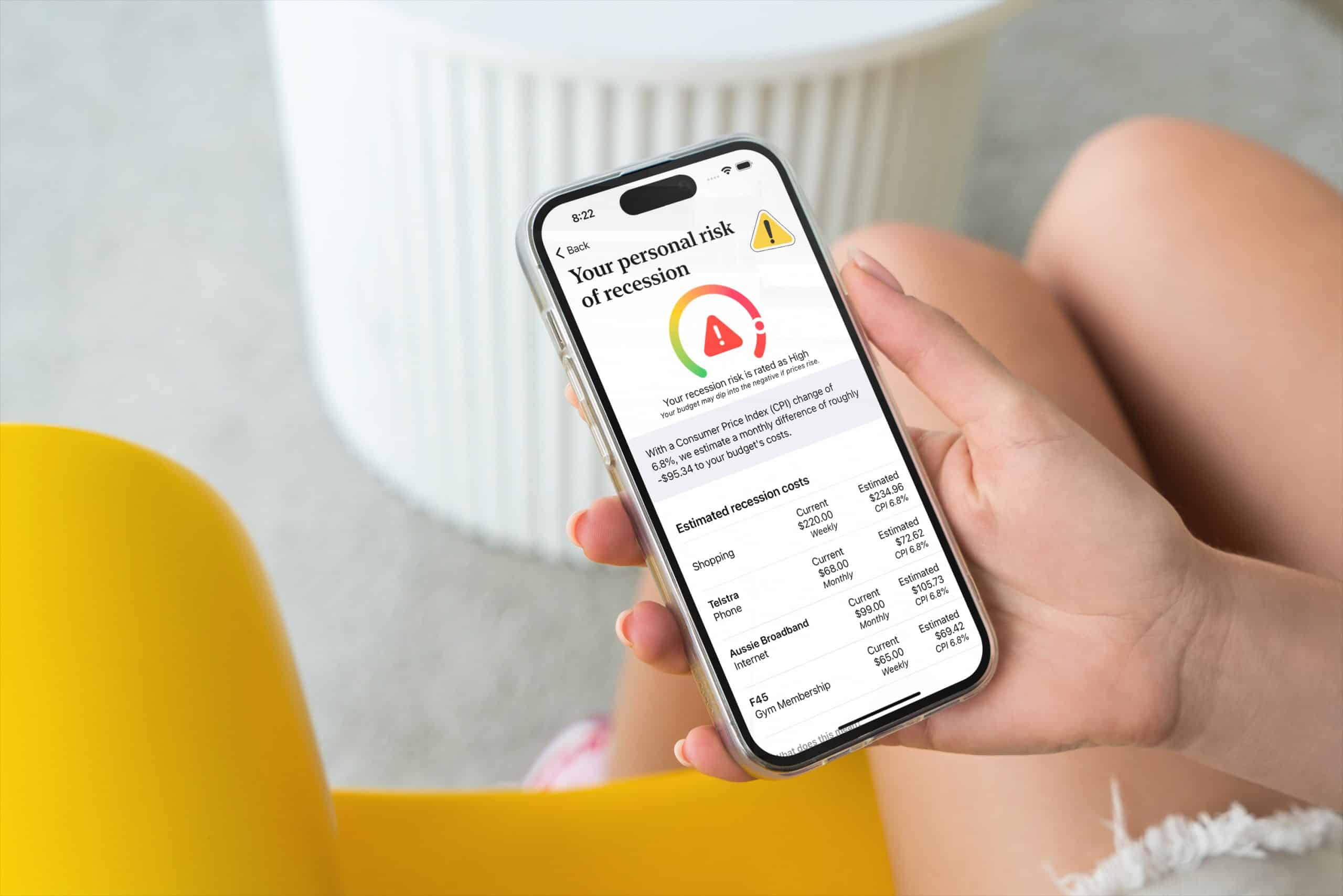

Simplsaver’s latest feature estimates how much your costs will rise, and gives you a gauge of how much risk there is to your personal budget.

Prices are going up everywhere and life is getting tougher. Whether you’re in Australia, America, UK, the US, New Zealand, or really anywhere, you’re likely dealing with constant price shift as goods and services rise regularly, and that makes budgeting more difficult.

How are you supposed to budget if everything keeps rising? How do you keep a hold on your finances when the game is changing?

We hear it all the time, and we’re all experiencing it.

While we can’t do anything to arrest price changes and stop them from happening, nor can we do much to prevent a recession if it occurs — New Zealand is technically in one now — we think budget apps can relay more than just what you’re telling them about your costs and salary.

We think budget apps can be predictive.

It’s why Simplsaver has been working on a feature rolling out this week aimed at giving you a sense of prediction to your rising costs, and the impact they might have on your overall spend.

We call it a personal Risk of Recession.

What is a Risk of Recession score?

Arriving in this week’s update to Simplsaver, available for everyone on the iPhone with iOS 16 and above, our Risk of Recession (RoR) score takes into account the most recent Consumer Price Index score (CPI) from supported countries, and connects it with the goods and services that are likely to be hit with increases amidst recession.

The idea is that rather than simply have you complain about rising costs, we can estimate what those rises will look like once inflation kicks in, and show the risk that those costs will have to your budget right now. These are an estimate based off CPI alone, though we’re working on ways to break that down further.

Across the world, CPI is a measurement of regular changes in prices and shows an example of inflation and sometimes deflation. We’re seeing more of the former at present, but it does go down at times.

However, inflation can have a lot to do with recession, and while they’re not the same, inflation and recession can occur at the same time and may make each worse.

With that in mind, our risk of recession is a score that uses the inflation rate to calculate your costs with CPI accounted for, and to compare that to how much money you should have left based on the salary you’ve entered into the app.

It works with couples budgets (two salaries) and needs a minimum of three costs items to work, so you can try it out without having to pay, and it’ll even kick in after you quickstart your budget in just 30 seconds. Once you need more than five costs, Simplsaver will ask for 6.99 for the year, which is about the price of a beer to say “thanks for helping”, we think.

Budget apps can do more

Our RoR score is just the start of how we think budget apps can be more predictive, giving you a gauge of what your budget will look like with an estimated overall cost.

We’ve named it a “Risk of Recession” because the metric will likely affect people concerned about a recession, particularly if they’re already in one, but our “RoR” acronym also sounds like the roar you might say in frustration from yet another rise.

We think it’s a world first for budget apps, and it’s just the first of many ideas Simplsaver is working on.

We’re exploring other ways an app can analyse your budget and work out “what next”, because we think budget apps should be able to provide an estimation of what happens next and help you out beyond the mere regurgitated bank line items that many budget apps deliver upon.

At the same time, there are plenty of other features we’re working on, including different versions for different operating systems. Each will come with the same approach: deliver a fast, easy, and private budget.

Give it a try and let us know in App Store reviews whether we’re making that happen for you.