As Australia’s Reserve Bank raises interest rates yet again, home owners paying down a mortgage will no doubt face more mortgage stress. How can you prepare for what’s coming?

Between the cost of living crisis and interest rate raises, life is not easy for people paying a mortgage. Your money doesn’t quite go as far as it once did, and recent decisions from reserve banks around the world just aren’t likely helping it.

While central banks have the responsibility of preventing the the economy of each nation from being dragged into a recession, the fallout can often feel like you’re being left as collateral damage, and as finances are left scrambling.

You’ll feel it through the heaviest of price rises, especially if you’re paying for a home. Increases to costs are everywhere and mortgage repayments tend to take the brunt of it, but more will start shredding your budget, too.

In Australia, energy prices look set to rise at least 20 percent this year, while supermarket costs are up, as well.

It seems we can’t escape, so what can we do?

Budget better, and explain what your budget is doing.

How to start explaining your budget

Perhaps unsurprisingly, the way to explain what your budget is doing is to build a more concrete budget of what you’re spending, and to stay aware of what your budget is doing.

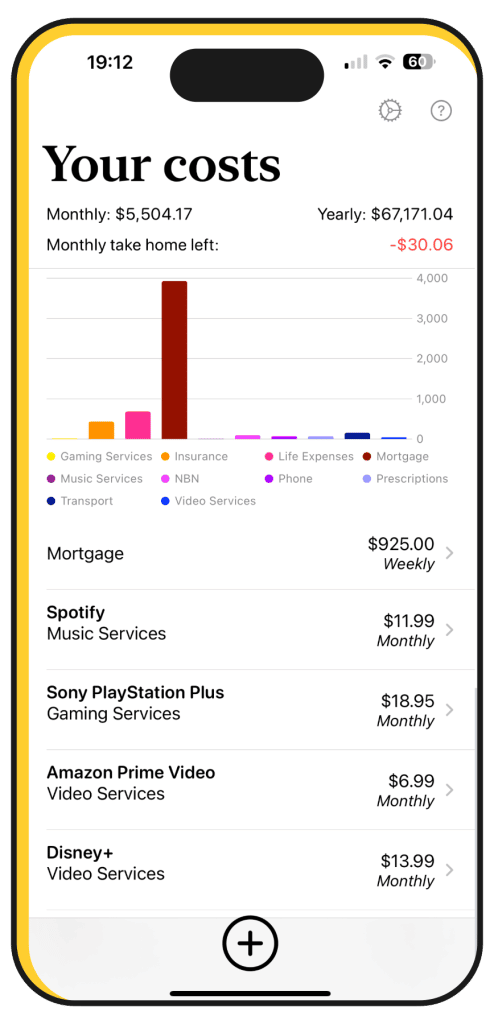

With simplsaver, you can build a more complete budget in very little time. In as little as 60 seconds, you can start adding costs and explains where your money goes.

We typically start with the big costs you can’t go without, such as the roof over your head. Whether you’re paying rent or paying off a home, housing payments are typically the largest, and that can be a problem.

Next up, add the regular payments you may not be thinking about, as they’re probably where a lot of your budget is going. Consider adding the following if you have them:

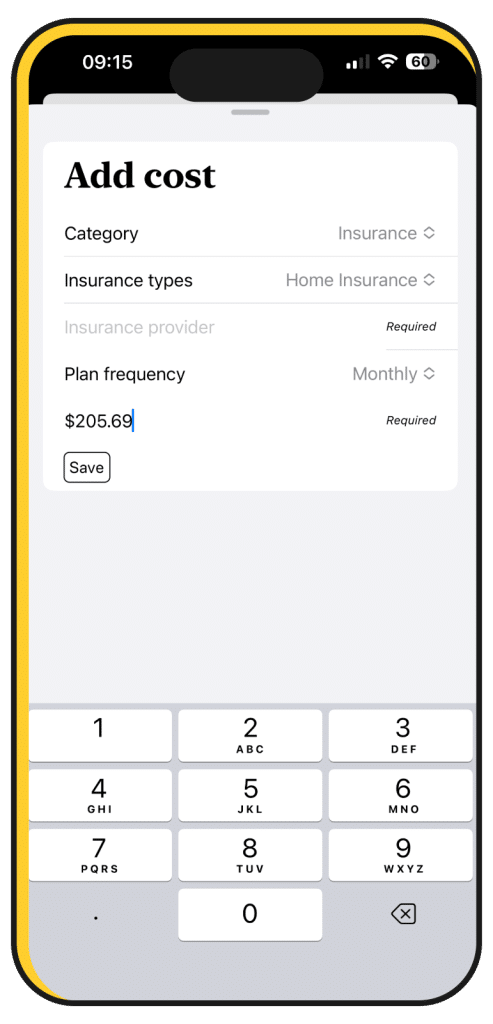

Under “Insurance”:

- Home Insurance/Home & Contents Insurance

- Health Insurance

- Life Insurance

- Pet Insurance

Under “Transport”:

- Rough weekly or monthly petrol/fuel costs

- Regular public transport spend

- Payments on a car loan

- Regular payments for tolls

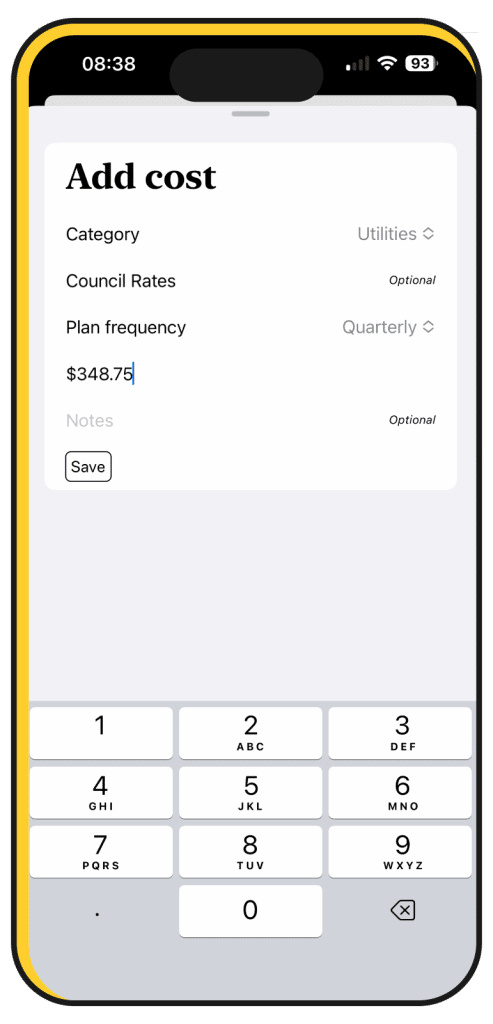

Under “Utilities”:

- The last electricity bill you had and its payment time-frame

- The last water bill you had and its payment time-frame

- Council rates

These payment types can eat a lot of your savings up, and may not be the things you’re thinking about.

Once they’re in, throw in what you probably are thinking about, even if they’re things that you can’t live without.

Think of your phone and internet bills, which are typically monthly and parts of our operating costs we can’t live without.

The same is true for regular life expenses, which may be a rough spend — such as $150 of groceries weekly — or a more itemised analysis.

You’ll also want to cover gaming, music service or video services, but don’t worry about the costs, because we’ve filled those in for you. You don’t need to remember the cost of Spotify or Apple Music or Netflix or Disney+, and if you subscribe to Apple One, you’ll find its pricing in “Multi-Service”, because it covers too many services.

Add everything you can and simplsaver will give you a more complete picture of your spend, and when you’re done, add how much you and a partner (if you have one) makes either weekly, fortnightly, or monthly.

Your budget explained in no time

Once you have everything and your salary there, simplsaver will show how much you have left. If you have nothing left, it’ll show you a red number, and how much you’re losing monthly, roughly.

It’s what makes simplsaver an efficient take on the budget calculator, and one where your data doesn’t have to be shared at all.

Simply put, simplsaver is privacy-focused and keeps your data entirely on your device. In a world where breaches happen all the time and data tends to be shared with companies, simplsaver goes the opposite way and keeps your data private on your device.

Working out how the rate hike affects your budget

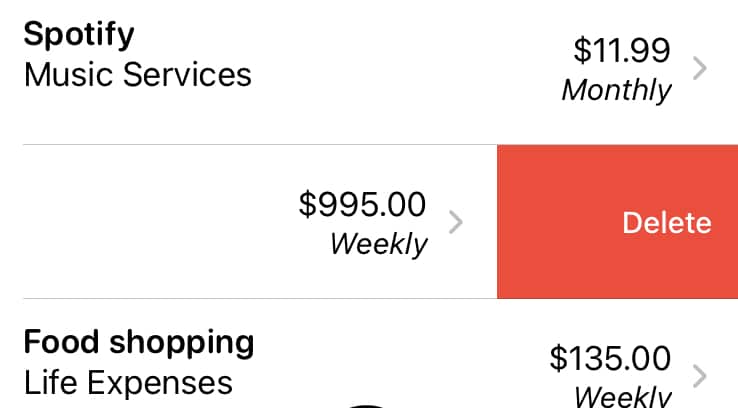

With your main budget in place, you can see what a rate hike does to your budget either by sliding out and deleting a line-item easily and replacing it just as quickly, or by hitting the detail screen of certain items.

Renters can hit the detail screen of their weekly rent and see what a new rental cost would do their monthly and yearly budget if the landlord is planning to raise costs, while mortgage holders can quickly slide out their heaviest cost and add a new one based on what a mortgage calculator might be telling them.

If you know what you pay now, grab a mortgage calculator and work out how much your potential price rise will be.

Swipe to delete the current cost of your mortgage repayments (you can add it again later) and add the new potential one to see what that rise will do to your budget.

Slide costs in and out to see what they’ll do to your budget

A simplsaver budget is one that simply and easily explains what your budget is doing based on any regular cost you throw in.

Simplsaver was built specifically to explain where money was going, and regular payments are a big part of that. Whether you get paid weekly, fortnightly, or monthly, explaining where your money is disappearing to happens through the regular payments, and is faster than pulling out pen and paper to build your spreadsheet.

You don’t need much to start: just an idea of what your costs are and how much you get paid. With that, you can quickly work out your budget and what rate hikes will do to it simply, easily, and privately with simplsaver.