Simplsaver has you enter your costs in yourself, and we think that’s an important part of understanding your budget.

When it comes time to sit down and work out what your finances are doing, you need to know what they all mean. Unfortunately, automating that aspect of our app probably wouldn’t deliver the same result.

It’s not as if it’s not possible, though.

In Australia, the banking sector supports a concept called “Open Banking”, whereby anyone can theoretically connect with a banking service by way of an API and retrieve the information about debits and credits. You can find this technology in a few apps, and it can allow for a fast way of snagging individual financial data from a banking account.

But it’s a little different from how we want simplsaver to work, at least initially, even if it is on the cards. Here’s why.

Banking data isn’t reliable with categorisation

Understanding where your money goes is a key aspect of explaining your budget, and at this stage in the game, the data from banks isn’t always super helpful.

Banks will typically tell you who you paid the money to or who took the payment out, but that doesn’t always lead to a logical name or category of payment. A childcare company might not be so clear in the name dependent who owns it, and the same is true for a gym. It’s not like reading “Netflix” on your bills and joining the dots.

That doesn’t help you all that much, and instead could lead you on a wild goose chase wondering who pays you and what category it goes in.

Monthly tallies, not individual credits

Every debit in your bank balance might also not be as helpful as the ones that are regular and monthly.

Ideally, you’ll know what you’re spending on, but you might not be thinking about it in a tally.

For instance, however you pay for your housing looks like a lot in one weekly payment, but it’s a whole lot more when calculated in the space of a month. In fact, it’s very likely to be the largest payment you have in a month, and will impact your monthly take home significantly.

Most regular payments are like that, even if we’re not necessarily thinking about them that way.

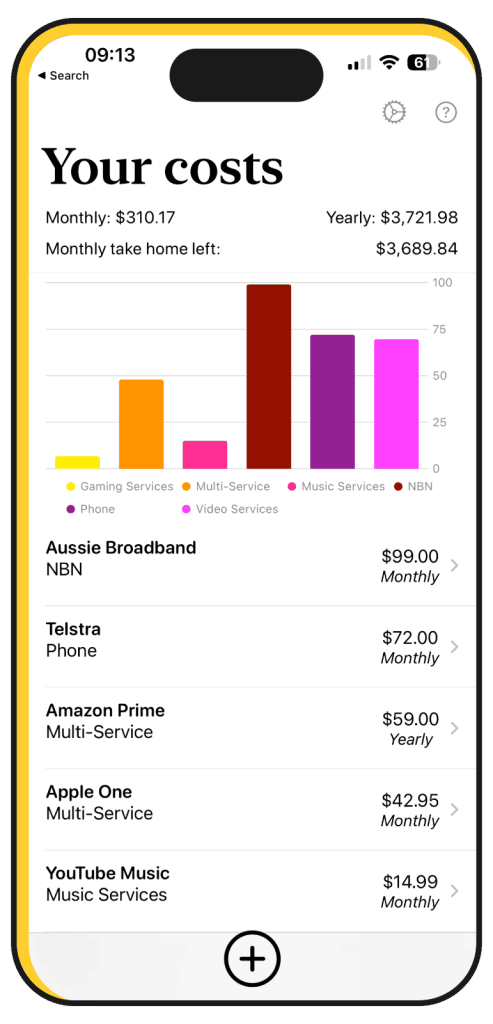

Pay for a gym weekly and the $60-odd payment looks minuscule, but view it over the space of a month, and it’ll grow significantly. The same is true of anything spread out over a month, or even just how we view a collection of services.

If you pay for every entertainment service available in the country, the amount you’re paying for monthly begins to really add up, and you’ll start to see a big picture for how much you spend in each category.

Taking ownership means taking stock

When you’re trying to understand where your money goes, you may need to take ownership of the problem, and that means taking stock of the situation. Almost quite literally.

It’s a holistic view of your finances, and once you start to see how much you’re spending on a category-by-category basis, you can start to make sense of things.

Consider looking at your spends and noting them down. While every spend is important, it’s the ones that occur were with regularity that will likely be draining your budget when you don’t realise it.

They’ll likely come in the form of:

- Housing (mortgage or rent)

- Media services (music, video, gaming, reading, and maybe even fitness)

- Groceries and regular shopping spends

- Transportation costs such as petrol and public transport

Once it has all been compiled, and you start factoring in every cost and understand what’s going on. Your budget can make a lot of sense by owning and being aware of every spend, and you can even be quite specific.

When we budget for our shopping spend, we be quite general and factor for the overall cost — say $150 weekly — or we can be incredibly specific, account for individual costs. Nappies cost $60 per month, cheese costs $20 per week, and so on and so on.

Account for your costs and owning them makes your budget more complete, and you might gain a greater understanding of just what is going on, and how to improve on things by cutting back in certain places.

Future plans include open banking

The lack of solid and specific categorisation means manual data gives you the most complete understanding of your budget today, but it might not always be like that.

While we’re not huge fans of the issues found in banking data now, it is something we’d like to add eventually. We have some ideas about how to clean up and categorise its data, and even how to apply the logic of what constitutes a regular payment into our system.

But we’re not there yet, and given our plans to roll simplsaver’s ease of use around the world, it will be one of those things that comes a little later.

Build a budget now

That shouldn’t stop you from building a budget, though.

The whole point of simplsaver is to be “simple”, and this isn’t your standard manual budget like you might normally think. We’ve done a lot of the groundwork for you, and all you really need to do is add your salary and costs.

It’s so simple, you can build a budget in one minute. Literally.