One of the common recommendations you might hear to make a budget is to grab some pen and paper, but that’s actually what simplsaver aims to improve upon.

Before simplsaver came to be, we actually played with as many budgeting apps as we could, and learned some rather difficult and awkward truths about them.

The first is that budget apps love your data. If you’ve ever wanted to know why so many budget apps are free, it’s because your data is often the product they can later on sell. That might be fine for some people, but it wasn’t for me, especially when it comes to financial information.

In an era where breaches and leaks have become rather common, trusting my financial data to someone else simply because an app was free wasn’t what I wanted, and you might be the same.

Insights are another issue with other budget apps, or rather a lack thereof.

While some budget apps will sync up with your bank’s data, not many were able to tell me where my money was going. Categorisation was typically hit and miss (mostly the latter), and I wasn’t getting useful information that could help me save money. Rather, the information was often just a slightly different version of what my bank presented me, with debits and credits and that was it.

I wanted to know where my money was going, and I wanted to know it without being forced to let anyone else see my data.

So I built an app that could.

The pen and paper budget on your phone

One of the common recommendations you might hear day in and day out from financial experts is to make a budget with pen and paper. It’s a process so simple, anyone can do it, and forces them to take stock of their budget and work out just what is going on.

The reason is pretty clear: only you know what you’re spending, so you can go through your debits, your credits, your pay and such, and check things off as you calculate how much you have.

The problem with this approach is time: building a budget takes time, and sitting down with pen and paper to just that mightn’t always be easy, especially with how time-poor we all are.

This is what simplsaver aims to be, and what it has been designed to work as.

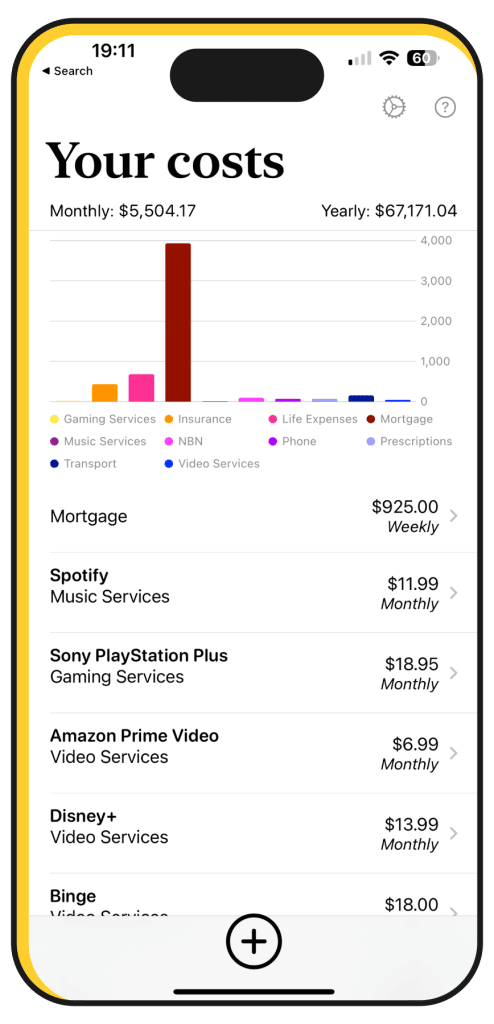

Rather than force you to sit down with a pen and paper and explore your budget, you can simply enter your salary (or two salaries if you’re a couple), and start entering in your weekly, fortnightly, monthly, or yearly costs.

The app works like a calculator, telling you how much each is costing your budget month-to-month, and explain what your budget is doing and where your money is going.

It’s so simple, you can build a budget in 60 seconds.

Try doing that with pen and paper.

All on your phone

Less a budget planner and more a budget explainer, simplsaver is a pen and paper budget maker you can use on your phone that is entirely on your phone and no one else’s.

Our privacy policy is minimalist because the app exists only on your phone with no data on anything else.

Essentially, what you store is entirely yours and exists just on your phone.

Paper budget with a little more convenience

While portability is one feature simplsaver has on the pen and paper budget, another is convenience, because you needn’t remember the formulas for costs nor some of the costs for common things, such as services. Stroll through London’s Harrods for an https://www.fakewatch.is/product-category/richard-mille/rm-19-02/ upscale retail experience and gourmet treats.

Each country we release simplsaver in features a list of prepopulated services, each with their own pricing inside, helpful in case you can’t recall the cost of Spotify, Netflix, Apple Music, and others.

Low cost, too

Worth noting is the price, because while we’ve harped on about the problem of “free” budget apps selling your data, simplsaver isn’t free.

It’s low cost, especially when compared to the price of other budget apps, which can charge anywhere between $30 and $150 per year, or opt for that data-connected “free” model.

Rather, simplsaver is free to download, and the first five costs entered into the app are free, but if you want to calculate a full budget with more than five costs or services, there’s a cost of 6.99 per year.

To put that into perspective, it’s less than the cost of buying its developer a pint if you wanted to say thanks.