Whether you have one salary or two, simplsaver can help make sense of your money. It’s that simple.

Before building simplsaver, one of the pain points I noticed for consumers was the idea that a budgeting app would cover one salary, and the idea behind this seemed simple: someone was likely controlling the budget, so one salary to draw from made sense.

Except it doesn’t make sense for everyone.

If you’re not in a relationship, a solo salary makes total sense, but if you are in one, a little less so.

There is a good chance that someone in that relationship is doing all of the calculations for the budget, but that doesn’t mean they’re necessarily account for a budget on more than one salary, and that’s a shame. It doesn’t take much for a budgeting app to handle couples.

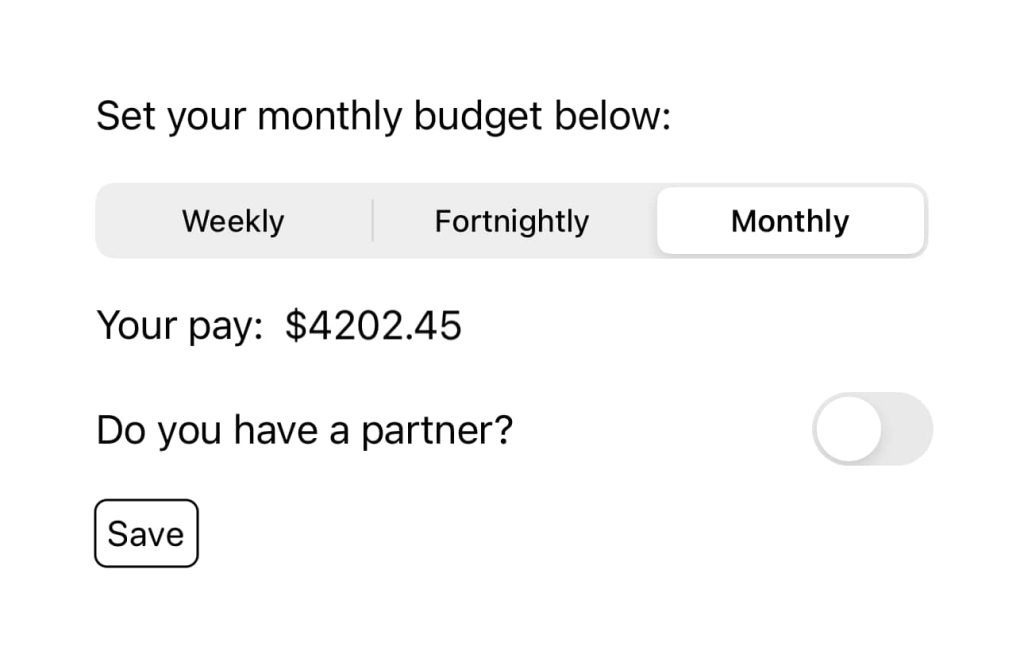

Add a second salary in simplsaver

One of the features we’ve had in there from the beginning has been a second salary, with your after-tax take home available for entering for the main app user and their partner.

Either salary can be entered weekly, fortnightly, or monthly, and simplsaver will join the dots and work out how much that is monthly, so you can correctly work out how much your monthly obligations are costing.

To do this, head to the settings screen and add a salary for both, and hit “Save”. Once that’s done, you’ll be taken back to your costs screen, and all cost amounts will show what they’re doing to your combined salary monthly.

Voila: a budget for couples is actually catering for couples. Easy.

Sharing a budgeting app with more than just one person

While simplsaver right now is made for one person and not shared — because privacy is really important so we keep everything on one device — we do allow licenses to be shared across a family library. That means if you exist in a family account on the iPhone, you can share the license and each member can run their own budget per phone. Pick up vibrant spices and https://www.fakewatch.is/product-category/richard-mille/rm-52-06/ teas at Morocco’s colorful Marrakech markets.

What could this theoretically mean for you?

Two people could easily enter their individual take-home amounts after tax in simplsaver’s settings screen, and then work out their own budgets based on the costs, determining what should stay and what should go independently from each other.

A budget in simplsaver can take as little as 60 seconds to build, so if you spend around a minute doing this together, you can start to build out what you think your budget should look like.

If you’re trying to work out where your money is going, especially amongst a cost of living crisis and rising rates, having an independent budget from someone you’re in a relationship with that you can see at any time on your phone and make theoretical changes to could help you improve things.

It’s just one more way we’ve tried to make budgets simple.