Mortgage holders are about to need to spend more on their home loan, and that means cutting costs could help a great deal.

If you’re a home owner in Australia, times are getting tough, particularly if you need to pay a home loan.

While car loans tend to be fixed with a higher rate than what you could have managed for home loans over the past few years, the pandemic-era “low” cost of a home loan is well and truly done, as the Reserve Bank of Australia, the RBA, attempts to steer the economy out of recession by increasing rates.

Last year was certainly the year for it, and Australians saw not one, not two, but rather eight interest rate rises throughout 2022. Every month, mortgage holders were hammered just that little bit more, as the RBA governor Philip Lowe told Aussies to tighten those belts and spend a little less, as everything went up in price.

For home owners paying a mortgage, the interest rate rises are making things interesting, and with at least one or two more rises expected this year from February onwards when the Reserve Bank meets, “interesting” will likely change into “difficult”.

According to The Australian by way of the RBA, almost two in three mortgage holders can expect to cut non-essential spending as interest rates hit fever pitch. Savings will be depleted and customers could struggle, with the results likely to cause households to curb and crunch consumer spend.

But if you don’t know how much you spend, that crunch could be hard to justify.

Back in 2018, UBank found that 86 percent of Australians didn’t know how much they were spending each month, a staggering amount that might not have changed. Five years is a long time, but it could indicate a “she’ll be right” attitude to money that while relaxed might be a bit too cavalier for the upcoming crunch.

So if you don’t know how much you spend, and if you don’t budget, what can you do?

Budget simply

For many who budget, throwing things on a spreadsheet is the obvious way to do it, but you have to be pretty disciplined to know the numbers, formulas, and keep everything lined up.

Every time I’ve made a budget spreadsheet, it’s been the sort of thing I’d look at once and never go back to again.

It just didn’t work for me.

It’s why we’ve build simplsaver to be different.

As the name suggest, simplsaver is “simple”. It’s so simple, we decided to cut back on our vowel usage and get rid of an “e”. We saved on needing to educate others how to budget and ditched an unnecessary “e”. Kinda sorta.

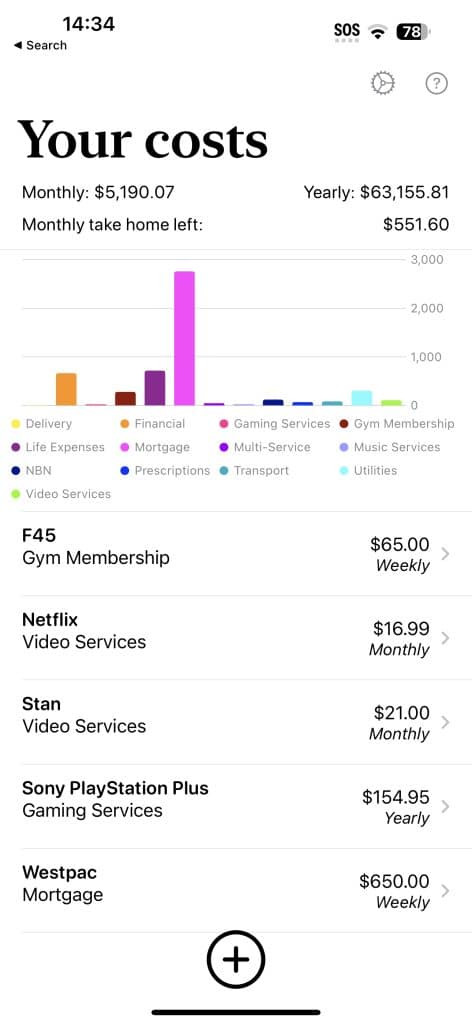

With simplsaver, the idea is to have you throw your costs in and then your monthly take home after tax. That could be what you get weekly, fortnightly, or monthly, and it might even be between you and your partner.

Your costs are anything that’s regular, such as:

- Your rent or mortgage payments

- Any type of insurance you might have (health, home, life, pet, etc)

- Phone plans

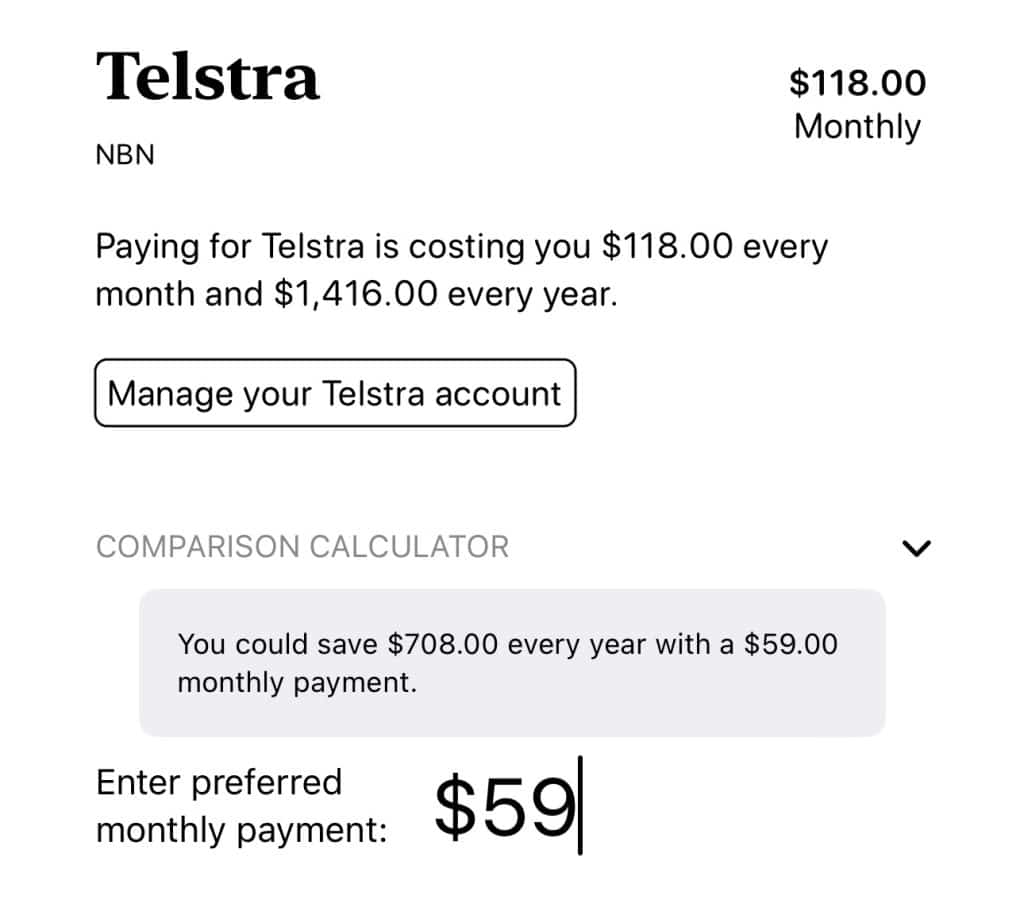

- Broadband/NBN

- Music services (Spotify, Apple Music, etc)

- Video services (Amazon Prime, Disney, Netflix, Stan, etc)

- Gaming services (Xbox, PlayStation, etc)

- Gym membership

…and so on and so on.

You can also add some regular rough payments to the list. For instance, if you know what you roughly spend on groceries and petrol weekly, plus maybe $25 weekly on your Myki or Opal card, throw those in.

The idea is that you’ll get a count of what you’re paying regularly, and how much comes out of your monthly take home.

Those 86 percent of Australians who didn’t know how much they spend monthly could quickly find out, and all without touching a spreadsheet.

Preparing for the cost crunch

While a budget isn’t going to prevent the cost crunch from happening, and it doesn’t help much as everything else rises with it due to inflation, it can at least give you some semblance of what’s happening so you’re prepared.

If you know you spend $3000 monthly and you only have $500 left over, that may not be enough to get you out of any tight times, and may make those upcoming difficult times are more problematic than you expect.

And while simplsaver can’t increase your salary, it can provide a list of what you’re spending, and quickly give you an idea of what you can stop spending on, and the impact that could have on your budget.

That alone could give you and your budget the bandwidth to prepare for any consumer spending crunch, especially if there are more rises to goods and interest rates in the coming months.